At Rice, Heard & Bigelow, thoughtful and balanced input from legal, tax and investment professionals benefits clients as they develop strategies for gift, estate and tax planning. Comprehensive services provided by the firm include the administration of trusts, investment management, tax planning and the preparation of income tax returns. We also develop and implement estate plans in conjunction with outside estate planning attorneys, and assist with philanthropic endeavors. We believe that our coordinated strategy produces the best overall results for our clients. We frequently take a leadership role in order to manage a complex project or handle delicate family matters. A core strength is our close relationship with each client, a relationship built upon trust and experience.

As almost certainly the first private trustee office in the nation, RHB is now one of the few places where individuals and families can go for professional management of their personal assets and affairs by individuals – not corporations – serving as their trustees. This traditional fiduciary approach is now highly unusual in the world of trust companies, corporate trustees, national banks, and institutional investment advisors. Rather than follow that path, RHB has remained independent and driven by the quality of its people and its clients.

Trustees at RHB forge close relationships with our clients, be they grantors of revocable trusts, fourth generation beneficiaries of an irrevocable trust or charitable entities. RHB trustees generally serve until retirement, avoiding the turnover of “relationship managers” or “account officers,” and often become trusted advisors to families on a variety of matters.

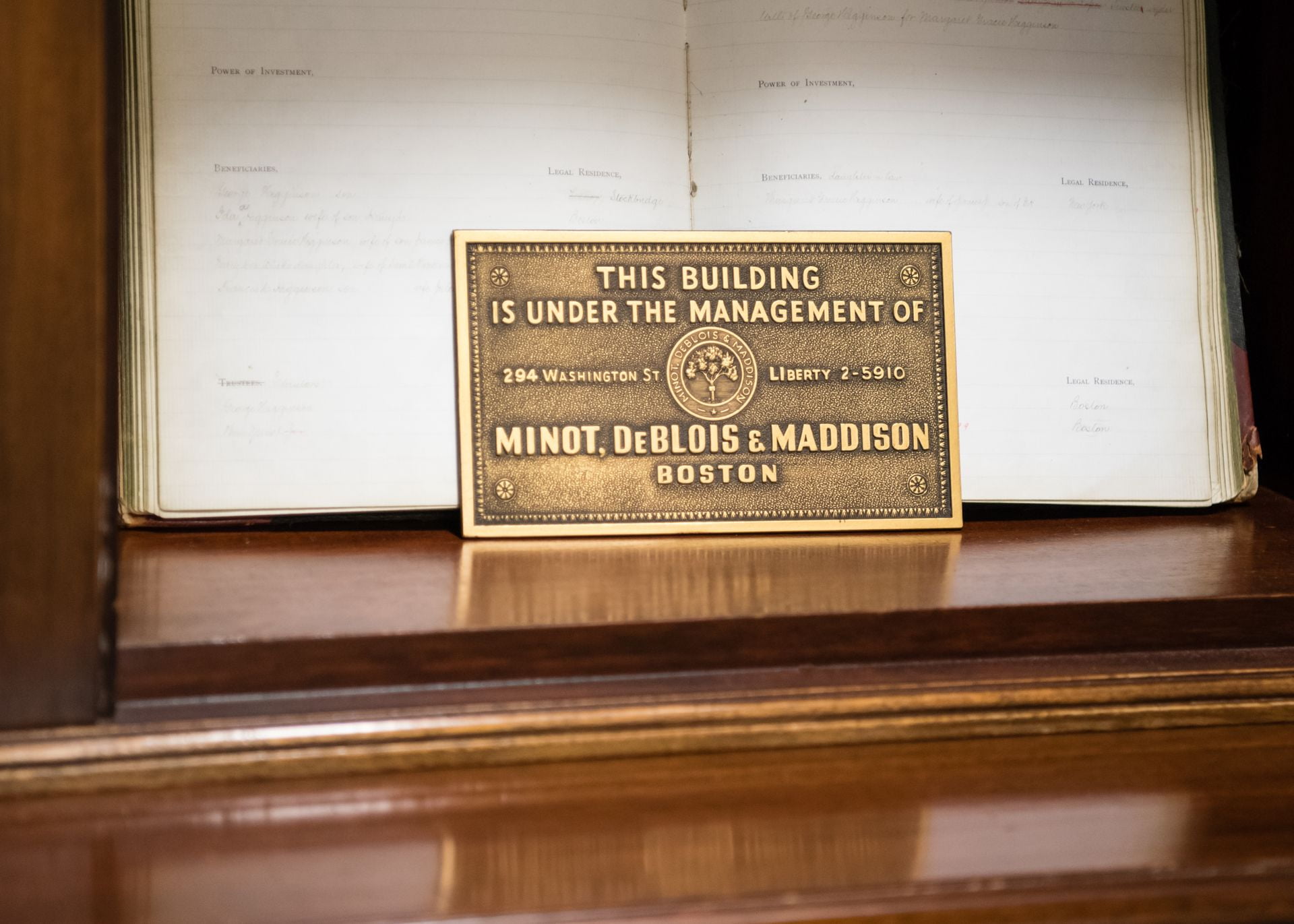

RHB trustees believe that the management of risk is as important in investing as is the search for return, and strive to create diversified portfolios in a disciplined and tax-efficient manner. Trustees at RHB are advised by Minot DeBlois Advisors, a wholly-owned registered investment advisory firm, regarding the investment of trust assets.

We maintain a flexible and highly individualized investment approach. The appropriate asset allocation in any trust depends on the risk tolerance of the client, the length of time we have to invest and the need for current income. We believe it is vital to know each client’s goals, objectives, constraints and tax considerations, and that communication and shared expectations are at the heart of successful investment results. To that end, one such example is revocable trusts managed according to Environmental Social & Governance principles.

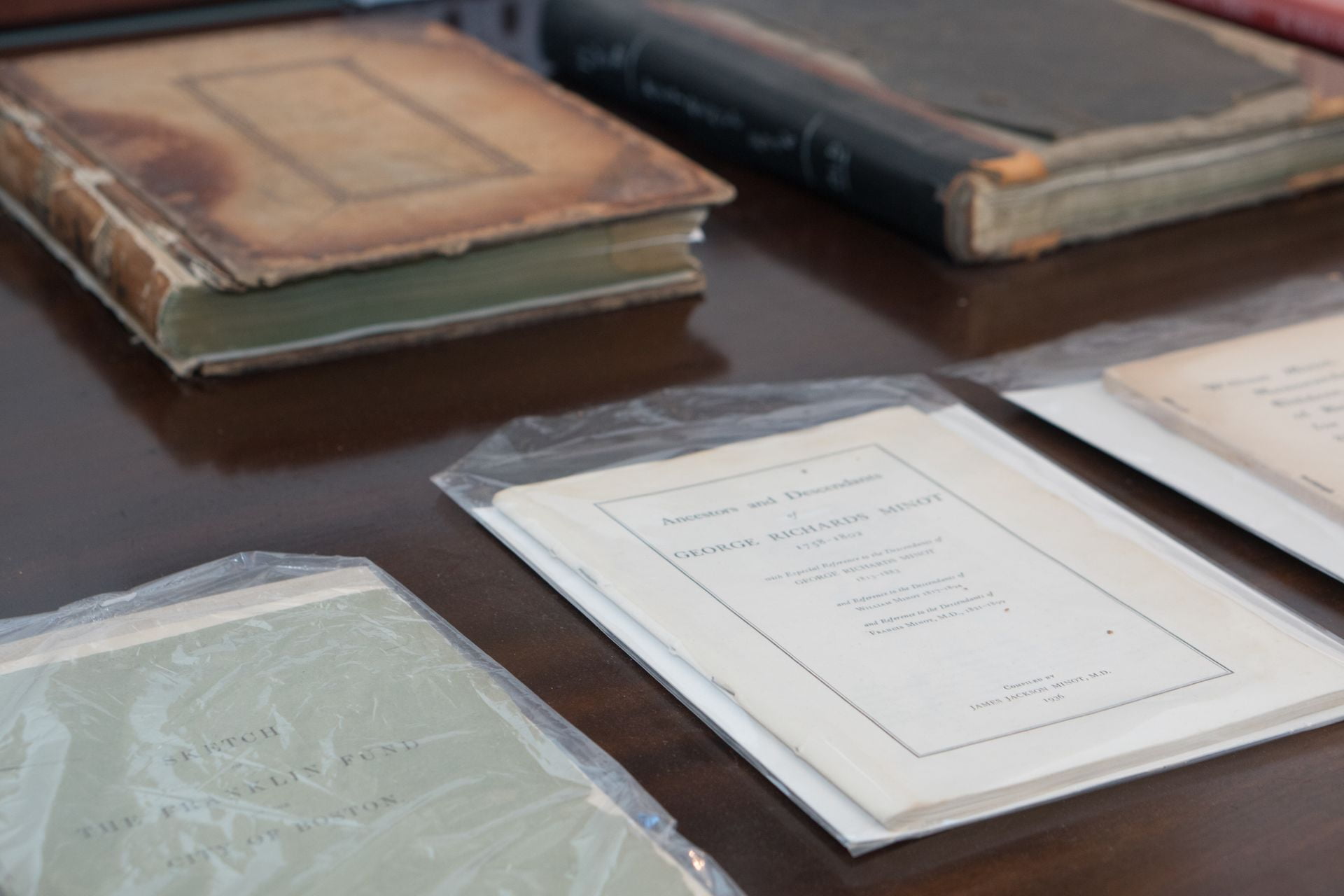

In the long history of Rice, Heard & Bigelow and its predecessor firms, the management of Benjamin Franklin’s bequest to the City of Boston is an interesting early example of what today would fall under the broad rubric of socially-responsible investing. Franklin’s bequest encouraged aspiring entrepreneurs by granting loans to benefit the next generation of businessmen like himself. Mr. Franklin’s trustees thus sought to achieve a social good while also earning an economic return for the charitable fund that was his financial legacy to the city.

Today as then, Rice, Heard & Bigelow stands ready to assist its clients with investing for social impact within the context of a prudent and diversified investment portfolio. If this is of interest to you, please ask us about ESG investing at RHB, and let us help you invest your assets in accordance with your values and goals. In all cases, the trustees will discuss with the client their fiduciary duty to invest with prudence and care as they incorporate ESG into the investment process. Although the creators of revocable trusts have wide latitude to direct that specific securities be held – or not – in trust portfolios, the role of beneficiaries of irrevocable trusts is consultative.

Two RHB trustees are experienced estate planning attorneys and, utilizing their knowledge of estate, gift, and GST-transfer tax laws, they routinely meet with clients to discuss their estate planning needs. RHB trustees work closely with a client’s outside estate planning attorney. We use our knowledge of the client’s financial situation, family circumstances and goals to streamline the estate planning process in a way that ensures an efficient result: a well-crafted estate plan.

RHB trustees also serve as personal representatives or executors and work with legal counsel to efficiently probate the estate, file the necessary estate and income tax returns and administer, terminate or fund trusts as required. In some longstanding family relationships, we also serve as agents under durable powers of attorney and health care proxies.

RHB’s tax department offers comprehensive services to individuals, trusts, estates and charitable entities. All income tax returns are prepared in-house by professionals with broad experience in handling a variety of tax issues on the federal and state levels. In combination with RHB’s expertise in trust administration and investment management, our tax department develops tax and financial planning strategies that enable the firm to better advise its clients. All tax preparation services are billed on an hourly basis.