Rice, Heard & Bigelow is a privately-owned firm of professional trustees serving individuals, families and charities. The organization of the firm is unique, in that the principals are named as individual trustees, rather than the company being named as corporate trustee. We believe our structure furthers the primary goal of discreet, personal service through long-standing trustee relationships. Many of the families we advise have been with us for generations. In addition to managing and administering funded trusts, the firm also prepares income tax returns for trusts, estates, charities and individuals. Other services include wealth, tax, estate and philanthropic planning.

It is our mission to be a safe harbor for those looking for independent advice, honesty, responsiveness and trust, all of which we trace back to the firm’s inception more than 200 years ago.

Meet Our Team

We maintain a thoughtful and disciplined investment approach designed for each trust portfolio.

Learn More About Trust Management

Trustees work closely with estate planning attorneys to ensure a personalized, accurate and well-crafted plan.

Learn More About Estate Planning

Our team of tax professionals provides comprehensive planning and preparation of income tax returns for individuals, trusts, estates and charitable entities.

Learn More About Tax ServicesThe key to Rice, Heard & Bigelow’s successful trust management is the collaboration across disciplines, which includes balanced input from estate planning, asset management and tax professionals.

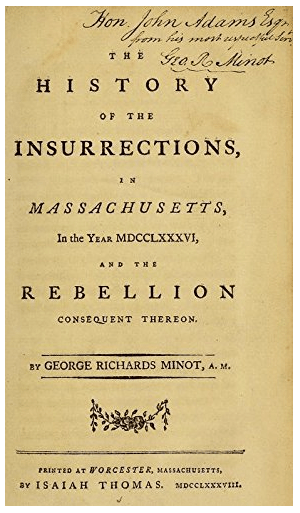

Four years after graduating Harvard as valedictorian, George Richards Minot nailed his sign to an elm tree on Court Street in Boston’s financial district and created the first private trustee office in the US. George Richards Minot was elected clerk to the Massachusetts House of Representatives, a post he served dutifully for ten years alongside several future American presidents.

George Richards Minot was selected by citizens of Boston as “Orator” of the city to deliver eulogy on death of George Washington.

John Quincy Adams eulogized George Richards Minot, as recorded in the minutes of the Massachusetts Historical Society.

Four years after graduating Harvard as valedictorian, George Richards Minot nailed his sign to an elm tree on Court Street in Boston’s financial district and created the first private trustee office in the US. George Richards Minot was elected clerk to the Massachusetts House of Representatives, a post he served dutifully for ten years alongside several future American presidents.

George Richards Minot was selected by citizens of Boston as “Orator” of the city to deliver eulogy on death of George Washington.

John Quincy Adams eulogized George Richards Minot, as recorded in the minutes of the Massachusetts Historical Society.